Are you facing unexpected dental bills? Many people find themselves shocked by the cost of restorative treatments like dental crowns or bridges. These procedures are essential for restoring damaged teeth, but understanding how your dental insurance covers them can feel incredibly complex. This guide breaks down everything you need to know about navigating dental insurance coverage for crowns and bridges, ensuring you make informed decisions and get the most value from your benefits.

What Are Dental Crowns and Bridges?

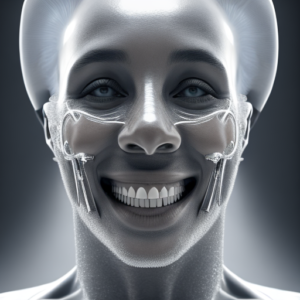

Let’s start with a quick overview. A dental crown is essentially a ‘cap’ that covers a single tooth to restore its shape, size, strength, and appearance. It’s often used after a large filling or if a tooth has been severely damaged. A dental bridge, on the other hand, uses one or more artificial teeth (pontics) anchored to adjacent teeth – typically crowns placed on those abutment teeth – to replace missing teeth. Bridges restore your smile and chewing function.

For example, imagine someone chips a significant portion of their front tooth. A crown is the ideal solution to protect the remaining healthy structure. Similarly, if a back molar has been extensively decayed and needs replacing, a bridge could be constructed using that tooth as an anchor and artificial teeth in between.

Understanding Dental Insurance Coverage for Crowns

Dental insurance coverage for crowns varies significantly depending on your plan type (e.g., PPO, HMO) and the specific details outlined in your policy. Generally, most plans cover a percentage of the cost, with you responsible for the remaining portion – often referred to as the ‘deductible’ and ‘co-pay’.

Types of Dental Crowns Covered

Most dental insurance companies will cover crowns if they are deemed “medically necessary.” This typically means the crown is required to protect a tooth that is weakened or severely damaged. Cosmetic crowns, solely for aesthetic reasons, are often not covered.

Here’s a breakdown of common coverage scenarios:

- PPO Plans: Typically offer higher coverage percentages (e.g., 80-85 percent) if the crown is considered medically necessary and you’ve met your annual deductible.

- HMO Plans: Coverage is often more limited in HMO plans, frequently requiring pre-authorization from your primary care physician or a dentist within the HMO network. They may cover 70-80% of the cost after meeting your deductible.

- Preferred Provider Organizations (PPOs): PPO plans generally offer a good balance between coverage and flexibility, often covering 70-85% if you stay within their network and meet your deductible.

According to a recent study by the National Insurance Claims Association, approximately 65 percent of dental insurance claims for crowns were approved, primarily due to structural damage or decay.

Pre-Authorization Requirements

A critical aspect of crown coverage is pre-authorization. Many plans require you to obtain approval from your insurance company before proceeding with the procedure. This ensures that the treatment is deemed medically necessary and helps prevent unexpected billing surprises. The process usually involves submitting a detailed treatment plan, including x-rays and a dentist’s recommendation, to the insurance company for review.

Failure to obtain pre-authorization can result in your claim being denied entirely or significantly reduced coverage. Always check your policy details to understand the specific pre-authorization requirements before scheduling any restorative work.

Understanding Dental Insurance Coverage for Bridges

Coverage for dental bridges is often similar to that of crowns, but with a few key differences. Bridges are generally considered more complex procedures than single crowns, which can impact coverage percentages.

Coverage Percentages for Bridges

Generally, insurance companies may cover 70-80% of the cost of a bridge if it’s deemed medically necessary. However, some plans might offer slightly lower coverage depending on factors like the type of materials used (e.g., porcelain vs. metal-ceramic) and the complexity of the case.

The Role of Adjacent Teeth

A significant factor influencing bridge coverage is whether crowns are required for the teeth adjacent to the bridge. If your insurance company requires crowns for the abutment teeth, it can significantly increase the overall cost of the procedure and potentially impact the percentage covered. Some plans may cover the bridge itself but not the associated crown work.

Case Study: Mr. Johnson’s Bridge Coverage

Mr. Johnson experienced significant tooth loss in his lower jaw. His dentist recommended a three-unit dental bridge to restore chewing function and improve his appearance. Initially, Mr. Johnson was concerned about the cost. His PPO plan covered 75 percent of the bridge itself, but only 60 percent of the crowns for his adjacent teeth. This meant he faced an out-of-pocket expense of approximately $1,800 for the crown work.

Out-of-Pocket Costs and Your Dental Insurance

Understanding your potential out-of-pocket costs is crucial when undergoing restorative dental treatment. These costs typically include:

- Deductible: The amount you pay before your insurance coverage kicks in.

- Co-pay: A fixed amount you pay for each service, regardless of the total cost.

- Coinsurance: The percentage of the remaining balance your insurance company pays after meeting your deductible (e.g., 20 percent).

- Non-Covered Costs: These can include cosmetic enhancements or unnecessary procedures not deemed medically necessary.

It’s essential to carefully review your policy documents and ask your dentist or dental insurance representative for a detailed estimate of all potential costs before proceeding with treatment.

Step-by-Step Guide to Understanding Your Dental Insurance Claim

- Initial Consultation: Discuss your treatment options with your dentist.

- Treatment Plan: Obtain a detailed written treatment plan outlining the proposed procedures and associated costs.

- Pre-Authorization (if required): Submit your treatment plan to your insurance company for pre-authorization.

- Procedure Completion: Once approved, proceed with the dental work.

- Claim Submission: Your dentist will submit a claim to your insurance company.

- Insurance Payment: The insurance company will process the claim and pay out the covered portion.

- Patient Responsibility: You’ll be responsible for paying the remaining balance (deductible, co-pay, coinsurance).

Key Takeaways

- Dental crowns and bridges are essential restorative treatments that can significantly improve your oral health and appearance.

- Coverage varies greatly depending on your plan type, deductible, and pre-authorization requirements.

- Always obtain pre-authorization before starting any significant dental work to avoid claim denials.

- Carefully review your policy documents and discuss costs with your dentist to understand your potential out-of-pocket expenses.

Frequently Asked Questions (FAQs)

Q: Does my insurance cover a second opinion? A: Yes, many plans offer coverage for a second opinion, particularly if the initial diagnosis or treatment plan is disputed.

Q: Can I appeal a denied claim? A: Absolutely. If your claim is denied, you have the right to appeal the decision by providing additional documentation or requesting a review from an independent medical reviewer.

Q: What if my insurance company doesn’t approve pre-authorization? A: You can still proceed with the treatment but be aware that you will likely be responsible for the full cost. It’s crucial to understand your plan’s policies regarding non-approved treatments.

Q: How often can I get a crown or bridge replacement? A: The longevity of crowns and bridges varies, but they typically last 10-15 years with proper care. Replacement may be necessary due to wear and tear, damage, or changes in your oral health.

Conclusion

Navigating dental insurance coverage for crowns and bridges can seem daunting, but understanding the key concepts outlined in this guide will empower you to make informed decisions and maximize your benefits. Remember that proactive communication with your dentist and insurance company is crucial throughout the process. Don’t hesitate to ask questions and seek clarification whenever needed. Investing in restorative dentistry like dental crowns and bridges can significantly improve your oral health, confidence, and quality of life – and with careful planning, you can ensure your insurance coverage plays a vital role in making that investment worthwhile.